February 15, 2023 Read Time:

marketingrevenue managementmetasearchparity

Surprised to find the OTA's are undercutting your direct pricing on various metasearch platforms, such as Google Hotel Ads or TripAdvisor? Don't be -- over 60% of all direct prices that appear in meta auctions are undercut by at least one OTA. We know that price is one of the most important factors when it comes to travelers booking their accommodations, so you are right to be concerned that guests who might otherwise book with you directly, are now booking with an OTA to save a couple bucks. While you likely have a contract with Expedia or Booking.com that requires both parties keep their rates in parity with one another, the reality is these OTA's often sell your inventory to a third party to resell. When an OTA is undercutting your rate, they are offering some of their commission directly to the guest, to encourage them to book with the OTA at a lower rate.

What means do you have to get an understanding of where, how, and why you're being undercut? Read on...

1. Ensure your rates are in parity: it seems silly to suggest, but the reality may be that you've provided the OTA's a rate that simply isn't in parity with your direct revenue management strategy. For example, if you are yielding rates (increasing the price as occupancy increases) and your channel manager is not integrated with your property management system, the OTA's are not receiving these increased rates unless you manually input them into the OTA's extranet. The first step to understanding undercutting of your direct rates is to ensure that whatever you're offering directly in terms of rate, you are also offering on the OTA's.

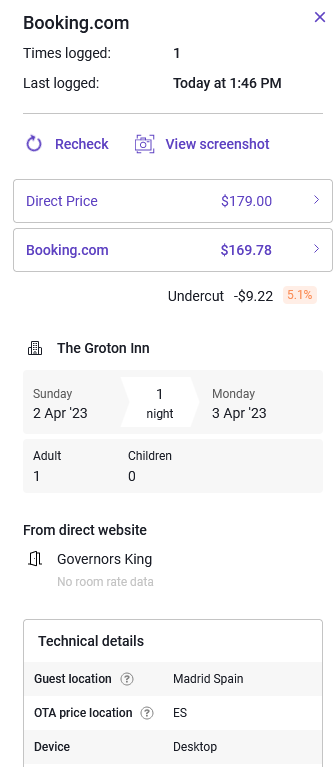

2. Use a parity tracking tool to understand specific undercuts: there are plenty of platforms out there that provide rate shopping services, such as OTAinsights or TripTease's parity tool. Both have their own quirks and idiosyncracies... OTAinsights is fantastic if you want to use an API to pull metrics out of the platform, whereas TripTease is a bit more user friendly. Both will provide you specific details on a specific search that was undercut... when the search was conducted, the room type searched for, the OTA that is undercutting, and the undercut amount. See a screenshot below (this is from TripTease) as an example:

You can use these parity tracking tools to determine WHEN you're out of parity, and why. In this case, we see that Booking.com has undercut this rate by 5.1%. Booking.com collects 15% commission for this property's particular contract, so that means in reality they're only collecting 9.9% of their commission.

Now that you understand how to determine when, where, and how you're being undercut, what do you do about it?

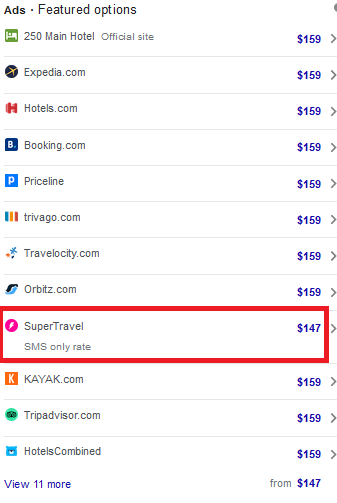

1. Determine if said OTA has a likelihood of converting: Expedia and Booking.com have a high level of trust (generally speaking) when it comes to the larger travel industry. Many travelers are familiar with these platforms and are willing to book on them to save money. But most users aren't willing to book with a platform they've never heard of before... would you risk booking with a platform you've never used before to save a couple dollars? Turns out, most folks won't.

2. Determine if the undercut is actually valid: It's incredibly common for an OTA to list a price that simply isn't accurate, they require you to book via a mobile device (liekly a very specific, well-hidden element of your OTA contract), or hide hidden fees from the first layer on the search. While this is against Google's policies for distributing deceiving or confusing rates to users, the reality is their mechanisms to moderate are not yet up to snuff. So lots of these sketchy OTA's might be promoting rates that aren't even bookable. See this screenshot below, where a $147 rate (vs. $159 offered directly) is only bookable through an SMS code. This is likely not an undercut worth stressing about, as most users are hesitant to provide their phone number to an OTA they've probably never heard of before (I hadn't heard of SuperTravel until I started writing this blog post and saw this search -- there are hunderds of them).

3. Undercut the undercut: Your metasearch provider probably offers a tool that allows you to create rules to undercut the undercutters. For example, you may create a rule that says "When Booking.com undercuts my rate by 5%, undercut THEIR rate by $1". You have to be careful with this strategy though, as it may lead to a race to the bottom, because the OTA may then decide to undercut your undercut of their undercut (hope that's not too confusing), further shrinking your rate. The goal here is to save yourself commission from OTA reservations, but if you're undercutting your own rates by 15% (thus not providing the OTA's any opportunity to collect any commission), then you're probably losing money through the time spent managing this process and the costs for such an undercut tool.

4. Destroy the notion of OTA parity entirely by offering direct bookers something you don't offer OTA bookers: The classic example is free parking. Direct bookers get to park for free, OTA guests don't. This results in some grumpy OTA bookers who you can advise "in the future, book directly with us, as we will match any OTA price with us", giving you an opportunity to educate them and turn them into direct bookers. Another great example is including breakfast in direct rates, but not the OTA's. Create value through your direct offerings, so as to incentivize folks to book directly with you!

In conclusion, not all undercutting is worth pulling your hair out over. Don't stress about sketchy, unbookable rates. Focus on OTA's that actually have credibility in the marketplace. What I didn't suggest here was going to your OTA rep and demanding they adhere to the terms of the contract. The reality is these companies have infinitely more legal resources than you do, and infinitely more clout with advertisers, Expedia spends about $5 million PER MONTH on Google Ads (how much on Metasearch specifically, we don't exactly know yet) and trust me, I've spent a lot of time trying to work with the OTA's to change their behavior. Focus on beating them at their own game!